|

|

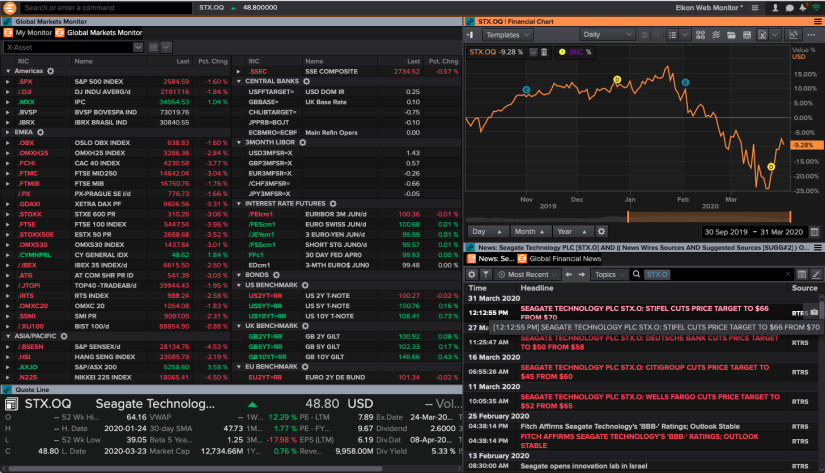

Eikon Desktop

|

Internet/Delivery Direct

|

Download Eikon Desktop

|

Wealth Management, Capital Markets and Advisory, Investment Management, FX Trading, Commodity Trading, Equity Trading, Fixed Income Trading

|

|

Eikon Web

|

Internet/Delivery Direct

|

Login to Eikon Web

|

Wealth Management, Capital Markets and Advisory, Investment Management, FX Trading, Commodity Trading, Equity Trading, Fixed Income Trading

|

|

Eikon Mobile (iOS)

|

Internet

|

Login to Eikon Mobile (iOS)

|

Wealth Management, Capital Markets and Advisory, Investment Management, FX Trading, Commodity Trading, Equity Trading, Fixed Income Trading

|

|

LSEG Workspace for Wealth Advisors

|

Internet

|

Download LSEG Workspace

|

Wealth Management, Capital Markets and Advisory

|

|

LSEG Workspace Wealth Advisors Web

|

Internet

|

Login to LSEG Workspace for Wealth Advisors Web

|

Wealth Management, Capital Markets and Advisory

|

|

Refinitiv Messenger

|

Internet

|

Download Refinitiv Messenger

|

Wealth Management, Capital Markets and Advisory, Investment Management, FX Trading, Commodity Trading, Equity Trading, Fixed Income Trading, Quantitative Analytics, Middle and Back Office, Risk, Fund Marketing

|

|

Thomson ONE Wealth

|

Internet/Dedicated Circuit

|

Login to Thomson ONE Anywhere

|

Wealth Management

|

|

Thomson ONE Banking

|

Internet

|

Login to Thomson ONE Banking

|

Capital Markets and Advisory

|

|

DataScope Select

|

Internet

|

Login to DataScope Select

|

Investment Management, Middle and Back Office, Fund Marketing

|

|

DataScope Plus

|

Internet

|

Login to DataScope Plus

|

Investment Management, Middle and Back Office

|

|

Tick History

|

Internet

|

Login to Tick History

|

Investment Management, Equity Trading, Quantitative Analytics, Middle and Back Office

|

|

DataScope Onsite

|

Deployed at Client End

|

|

Investment Management, Middle and Back Office

|

|

World-Check One

|

Internet

|

Login to World-Check One

|

Risk

|

|

Enhanced Due Diligence

|

Internet

|

Login to Enhanced Due Diligence

|

Risk

|

|

Knowledge Direct

|

Internet/Delivery Direct

|

Login to Knowledge Direct

|

Wealth Management, Capital Markets and Advisory, Investment Management

|

|

IFR

|

Internet

|

Login to IFR

|

Fixed Income Trading

|

|

LPC

|

Internet

|

Login to LPC

|

Fixed Income Trading

|

|

REDI EMS

|

Internet

|

Login to REDI EMS

|

Equity Trading

|

|

Datastream Web Service

|

Internet/Delivery Direct

|

Login to Datastream

|

Wealth Management, Capital Markets and Advisory, Investment Management, Quantitative Analytics, Fund Marketing

|

|

Lipper for Investment Management

|

Internet

|

Download Lipper for Investment Management

|

Wealth Management, Investment Management, Fund Marketing

|

|

Maxit Cost Basis Reporting

|

Internet

|

|

Wealth Management

|

|

Maxit Tax Information Reporting

|

Internet

|

|

Wealth Management

|

|

Maxit Tax Analytics

|

Internet

|

|

Wealth Management

|

|

Wealthscope

|

Internet

|

|

Wealth Management

|