Profitable research and analysis

Eikon brings together the industry’s best data and most powerful research and analysis tools to help you pursue profitable investment management opportunities with conviction. Get premier content on an award-winning platform to monitor the markets, generate ideas and strategies, and analyze strategies and securities.

Refinitiv Eikon's investment management tools

Informed investment management

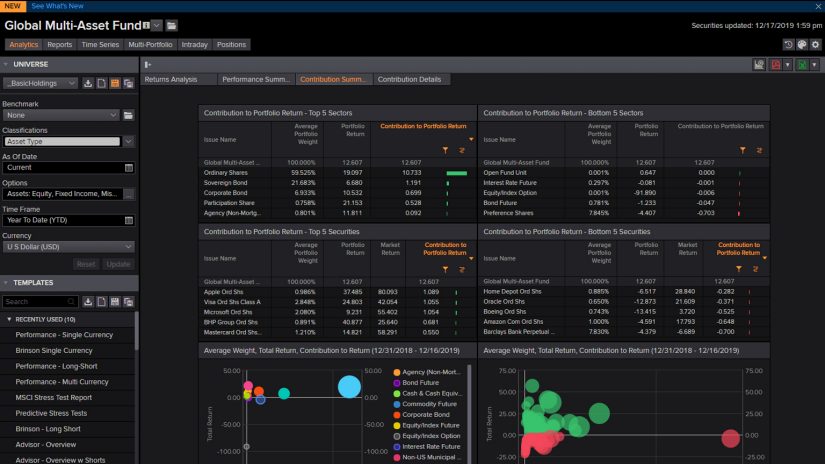

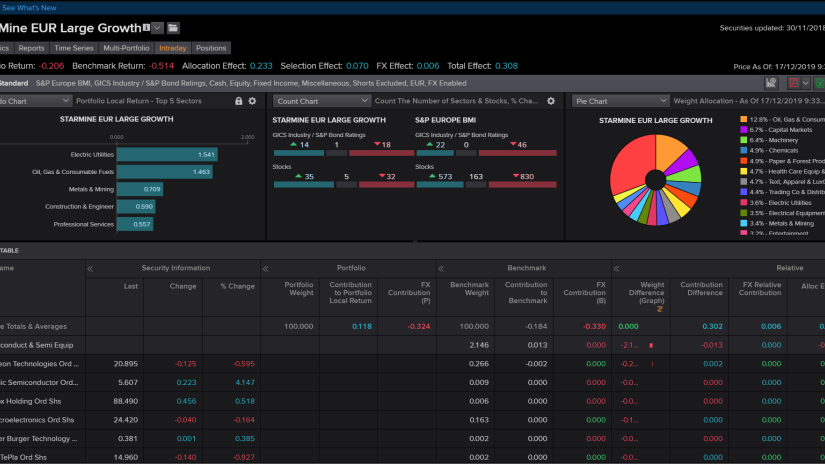

Better understand impacts on your investment portfolios with access to the very latest data, news, analysis, and charts. See how stock and sector market movements affect contributions to your portfolio’s relative, absolute return, and attribution numbers.

Drill down into the sectors and securities driving portfolio performance

View analysts' aggregated estimates on price targets and recommendations

Access investment research

View recommendations and estimates from your in-house investment analysts alongside those from external research providers. All research is tagged to particular securities, industries, regions, countries, and subjects. We have a panel of brokers that can be assessed through to their quality and value, structured for the scope of MiFID II unbundling regulations.

Manage multi-asset portfolios

Find your competitive advantage with our multi-asset class Portfolio Management solution, covering equities, ETFs, mutual funds, fixed income, currencies, FX forwards and listed futures, options positions and growing coverage of OTC instruments.

Analyze whether your portfolio is matching investment objectives

Customize your reports

Customize reports for clients

Utilize custom analytics templates to combine market information with your own data, logos, fund descriptions or disclaimers for final client-ready output. Build and manage automated batch reporting yourself or by fully outsourcing to our batching service for client reports.

Mitigate risk and manage areas of downside potential

Forecast and quantify portfolio risk with our proprietary Global Equity Risk Model. For multi-asset class portfolios, MSCI’s RiskMetrics provides risk analytics – including parametric and historical value at risk measures; VaR, IVaR, CVaR, MVaR methodologies; as well as market exposure and sensitivity analysis – to monitor and report on portfolio risk.

Forecast and quantify portfolio risk with our proprietary Global Equity Risk Model

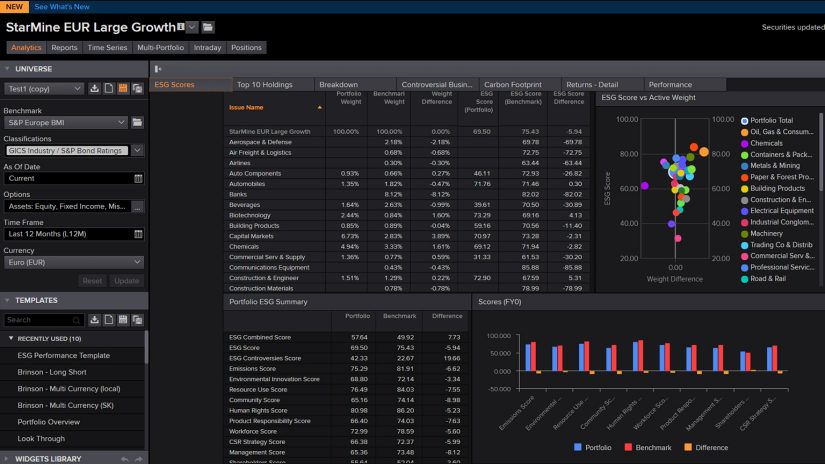

Aggregate and report ESG metrics for your portfolio

Measure and report ESG performance at the portfolio level

Aggregate and report ESG metrics for your portfolio. You can report against any aspect of a portfolio’s ESG profile (e.g. gender diversity, carbon exposure) to asset owners.

You can also perform an attribution report to test how an ESG tilt is helping or hurting performance.

Stress test portfolios to assess the potential impact of economic scenarios

Evaluating portfolio performance under different stress scenarios is an important requirement both for internal risk teams and regulatory compliance. Stress test portfolios with MSCI’s RiskMetrics to identify, report and adjust for downside risks.

Evaluate portfolio performance under different stress scenarios

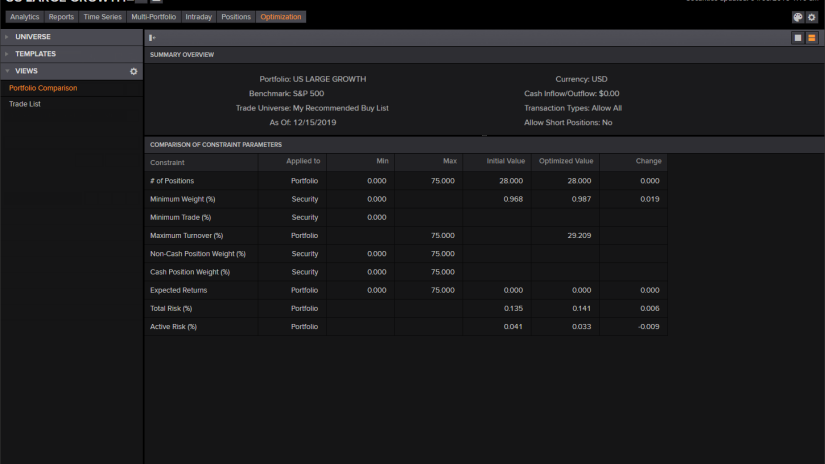

A more quantitative approach to portfolio construction

Optimize portfolios by managing tracking error and risk volatility

The Barra Optimizer in Eikon combines a powerful optimization engine with Refinitiv’s industry-leading content, enabling fund managers to demonstrate a more quantitative approach to portfolio construction to address index tracking, stock selection and asset allocation in an effort to maximize returns while minimizing risk.

Request details

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands:

+612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576

Help & Support

Already a customer?

Office locations

Contact Refinitiv near you

We're here for you

Have questions? We're here to help. Talk to a real person and get the answers that matter most.